22 November 2008

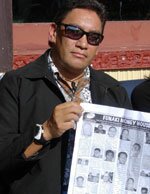

‘I’m no loan shark’ – money lender Johnson Funaki speaks out

June edition, 2006

By Amanda Snow: Te Waha Nui Online

Money lender Johnson Funaki makes no apology for his newspaper ads that shame people into paying back loans.

His name-and-shame pages featured in the Taimi ‘o Tonga show photos of people who have defaulted on loan repayments to his finance company, Funaki Enterprises.

They also outline the amount borrowed, what the money was borrowed for, and the church each debtor attends.

Operating from the back of his dairy in Otahuhu, Funaki says he is no “loan shark” and defends his unconventional methods.

“We’ve gone to debt collecting agencies like Baycorp, that I have to pay for, and they charge me for every letter they send.”

He says the ads in the paper, distributed in New Zealand and in Tonga, are a more effective way of recovering debt.

“It works. It really gets to them. If it doesn’t get to the actual people, it gets to the families or if not, then to the community – it’s very effective.”

He says he is often the last resort for people desperate for money after being turned away by their banks or other money lending organisations.

“I just service their wants and try to make a profit on top of that.”

But Otara dairy owner Sajjad Alam says the name-and-shame pages are appalling.

As he points to several people pictured in the Funaki Enterprises’ full-page advertisement, he says: “I know her, I know her and I know her. They are good people. None of them deserve to be humiliated like this when they are already struggling financially.”

|

|

Maori Party MP Hone Harawira has called for government restrictions on money lenders who charge interest of up to 30 per cent.

He says the ads are “bloody shameful” and is critical of the way loan sharks target poor communities.

He advises people to seek budgeting advice before signing loan agreements.

“Within some of these clauses are very cleverly written legal terms which ramp up the interest every time you default. They can then call in the assets, which force you to take out another loan to cover just the penalty — and then you’re back on the treadmill again. I find it very sad.”

Editor-in-chief of Taimi ‘o Tonga, Kalafi Moala, says he will continue to publish his client’s ads because money lenders such as the Funaki brothers are providing a service that the people of the Tongan communities “want” or in some cases “need”.

“The issue here is not advertising tactics but rather the abuse people make of these services. If the loan sharks are charging too much interest, the people should not be borrowing from them.”

- Feature: The high cost of easy cash